| The worst part of getting a new job is filling out that dreaded paperwork. The new boss asks about everything. They need to see your ID and Social Security card. They need your emergency contact and next of kin. But one of the most important things you fill out is your W4. This tells your employer how much to take out of your check for federal and state taxes.

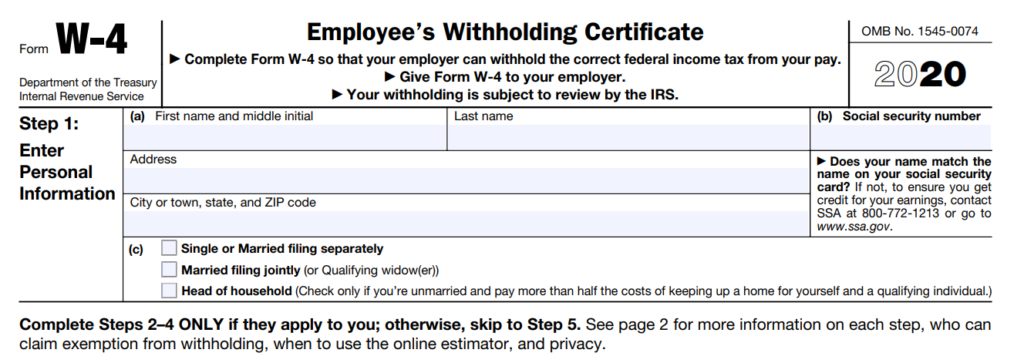

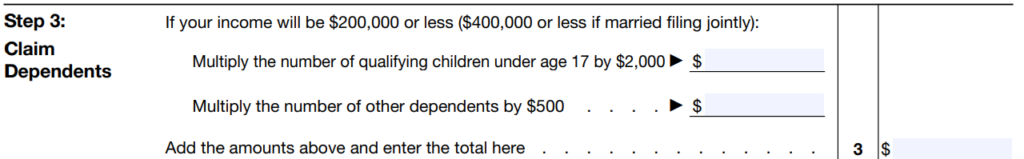

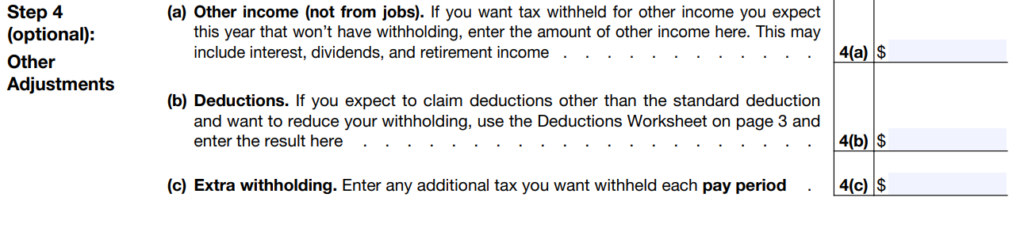

If you haven’t gotten a new job in a while, you might be surprised at the new W4. It changed completely in 2020. Now it is five sections, several pages of worksheets, and an online tool. Why a New W4?Here’s the breakdown: Withholding (what your boss takes out of your check) is based on how you fill out your W4. If you are single and have one job and no other income, you should break even at tax time. If you are married with a non-working spouse, also very easy. But what if you have two jobs or you are married and both work? Let’s break down having two jobs: This works if you have two jobs or you and your spouse both have one job. Job 1 pays $25,000 a year. Job 2 is part-time and pays about $10,000 a year. Since taxes at $10,000/year are zero, Job 2 employer will not withhold anything. Job 1 will withhold as if you are making $25,000. But you are actually making $35,000 and paying taxes as if you are making $25,000. This made a lot of people owe at tax time and is why the IRS made changes. The IRS decided to fix it in 2020. They got rid of the old form and, of course, made it more complicated. However, if you fill it out correctly, you should be able to owe zero at tax time. Let’s look at each step. Steps 1 & 5- RequiredThese two steps are required. This is the easy part. Name, address, social security number, status (single or married), sign, date, and move on to the next piece of paperwork. If you only do these two sections and nothing else, it will be similar to “claiming 0” from prior years and you should be OK if you only have one job and you do not have a working spouse. Step 2 – Check the Box for Multiple JobsStep 2 has one box. If you have 2 jobs or you have a spouse with a job, you need to check this box. You need to fill out a new W4 at every job and check the box. The result of checking the box is having more withheld from your check for taxes. In the situation above, where Job 1 is $25,000 and Job 2 is $10,000, without checking the box for both jobs you will not have enough withheld and wind up owing. (No tax refund!) Neither job is withholding as if you make $35,000, but you have to pay taxes on $35,000. It is not your employer’s job to do your taxes or know about you having another job. You have to provide this information, and that is what Form W4 does; it notifies your employer of how much to take out. Checking the box at each job will have your employer hold out more so you don’t owe when you file. Step 3 – DependentsNext is Step 3 where you claim your kids and other dependents. If you are single, enter the dependents you can claim on your taxes. If you are married, you need to coordinate with your spouse and be sure your combined total of dependents at all jobs equals the actual total of dependents between you. If you both claim all the kids, you will wind up owing. Each dependent is only listed one time on all jobs between you and your spouse. Do NOT list all your dependents on all your jobs. You will wind up owing. Be sure you know who a ‘Qualifying Child’ is and who is an ‘Other Dependent’. Any child who will be 17 or older at the end of the year is an ‘Other Dependent’. Your Qualifying Children are worth $2000 each and your Other Dependents are worth $500 each. You must do the math and enter a total. Step 4a – Other IncomeThis one is where it gets weird, even for the IRS. 4a and 4b both scare me. 4a is “other income not from jobs”. You can list on this line all your other income you need to pay taxes on. Interest, dividends, rental income, side hustle income. I’m hearing sirens in my head. Telling your boss about your outside income just seems like a really bad idea. You’re moonlighting? You have rental properties? Sounds like stuff your new boss doesn’t need to find out on Day 1, or maybe ever. Step 4a is optional. Step 4b – DeductionsStep 4b is also optional. This is where you total up your deductions (standard or itemized) plus everything that goes on Schedule 1 (Student Loan interest, IRA contributions, etc.) and list the total there. Again, your boss just sees the total, but do you really want the whole HR Department speculating why you have so many deductions? Beyond that, I know exactly zero people who would know the amount of last year’s deductions without looking at last year’s taxes. I also know zero people who can accurately predict their side hustle income for the year. Mind you, this is new hire paperwork that you fill out on Day 1 of a job you just started… and there’s a test on last year’s tax return??? Deep breath… there’s a glimmer of hope in Section 4c. Step 4c – Extra WithholdingFinal optional step is how much extra you want withheld total per pay period. If you have other untaxed income and want to pay extra from your job or if you have anything uncommon, you can enter your extra withholding here. How do you figure that out? The IRS has a great tool at IRS.gov/w4app. You can enter all your information while you relax at home. Coordinate with your spouse, review last year’s taxes, and find all the correct answers. You don’t have to disclose any personal finances to your new boss. You can take the correct numbers with you on your first day and not wind up in tax trouble next Spring. In Conclusion |

Form W4 has changed dramatically. Don’t get caught by surprise on Day 1 at a new job.

Only claim each dependent one time throughout all the jobs for you and your spouse.

Use the calculator at www.IRS.gov/W4app prior to starting your new job if you have a complex tax issue.