Can you lose money and owe taxes when you lost money? Yes, you can! But how can you owe taxes on a loss?

If you trade the same stock, bond, crypto, or other investment back and forth several times, your losses may be wiped away by the IRS. It seems crazy, like it couldn’t possibly be legal to tax people on money they never got. It’s true and there is a good reason why.

Your trades could cost you much more than your losses.

How Capital Gains Work

It all starts with how capital gains are taxed. Let’s pretend that we are investing in something. It could be a stock, mutual fund shares, real estate, baseball cards, or bitcoin. For this example, we are going to invest in a block of Swiss cheese.

I’m going to buy this block of cheese with my after-tax dollars from my paycheck and I’m going to pay $10 for it. I traded my $10 bill for a $10 block of cheese. No tax breaks, no deductions, nothing fancy. I have $10 less in cash and $10 more in cheese.

Then my neighbor comes over and he needs some cheese for a party. If I sold him my block of cheese for $10, I’d be right back where I started. I would trade my $10 in cheese back for $10 in cash. Nothing gained, nothing lost. But let’s say that I sold it to him for $12. I invested $10 and ended the day with $12. I made $2 buying and selling that block of cheese. That $2 is capital gains. You pay tax on the $2 of income.

Real-Life Drama

Investing could be that easy, but it never is. Let’s go back to the beginning of the story and add some real-life drama. I buy my $10 block of Swiss cheese. Later that day there is a news story saying there might be a cheese shortage due to supply chain issues and some mysterious cow disease. People start hoarding cheese. The shortage gets worse because of the hoarding. Remember 2020? Suddenly, there is no Swiss cheese on the shelf anywhere and the price skyrockets. Blocks of Swiss cheese are selling for $50. But I don’t want to sell my tasty cheese quite yet. Maybe I’ll sell if it goes up to $100.

At this point, do I have a gain? No. What something is “worth” is what someone will pay for it. Until you close the deal, you are only guessing. Maybe you can get $60. Maybe you’ll settle for $45. You don’t know until the deal is over.

Capital gains are not calculated based on some perceived value of what you might possibly get on a sale, they are calculated after the sale is complete. How much did you walk away with in your pocket? If the deal isn’t closed, if the cheese isn’t sold, you haven’t really gained anything, you are just making predictions.

More Real-Life Drama

After the cheese shortage when the market stabilizes, you decide you should sell the cheese. It is close to the expiration date and isn’t looking so well. You only get $7 for it. You paid $10, you sold for $7. You have a $3 loss. You can deduct that capital loss on your taxes.

But let’s add a little more drama to make it interesting. The next day, your cousin comes over your house and says, “I got this great block of Swiss cheese I heard you liked. I’ll give it to you for $7.” You buy your cousin’s almost identical block of cheese for $7. Great deal, right?

But what do you really have? You have an identical block of cheese as you had before. You gave back the $7 you got for it, so you are back to having $10 in cheese. You are back in the same place as you started, right? Nope.

It’s NOT the Same

What’s different is you have receipts to prove you had a $3 loss, yet you are in the same place as you started. $3 isn’t much. But what if you scale it up to real money? Let’s try this: I’ll buy 1000 blocks of cheese for $10,000. Next, I sell them at a loss to my neighbor for $7000. Then I’ll buy them back from my neighbor for the same $7000. I get a $3000 tax deduction based on my ‘loss’, my neighbor didn’t spend any money, and I still have all the cheese. I’ll never pay taxes again! Right?

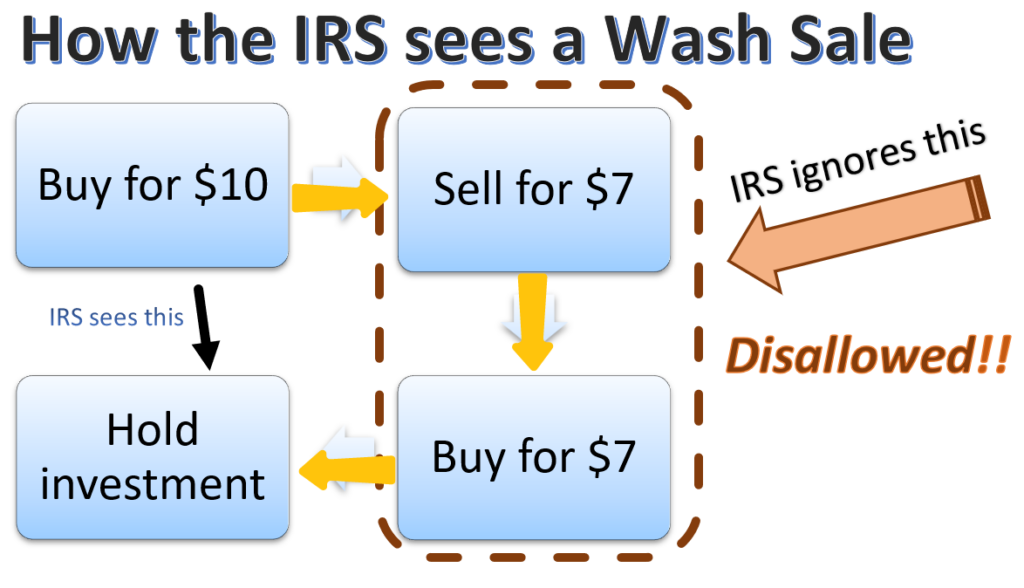

Wrong. This is why it is called a “wash sale” and this is why it is not allowed. The IRS does not look kindly on fake or manufactured losses through wash sales.

If you buy a nearly identical investment 30 days before or after a loss sale, it is considered a wash sale and the loss is disallowed. Brokerage houses report this on your statement and some crypto dealers are starting to report wash losses. However, it doesn’t matter if they report it or not. If you sell something at a loss and buy it right back, you can’t take the loss. Even if you buy replacements first and then sell at a loss, it is still disallowed. Buying nearly identical investments 30 days either side of a loss sale will get it disallowed. Having a lot of buys and sells of the same investment will get you audited if you are taking losses.

The math extends to other prices, too. What if you sell for $7 and buy back at $6.50? What if you buy back at $8? The loss is still disallowed even though the math is more than I can explain in this blog.

Why should I care?

If you are tempted to jump on the latest investment bandwagon – GameStop or AMC stock, dogecoin or shiba coin, toilet paper, computer chips, or whatever comes down next, pay attention to your buys and sells.

“It went down! I should dump it. Wait, it went back up I need to buy! I better sell before it goes down more. Wait it’s going back up I need to buy!”

This kind of activity will have you paying taxes on the gains and having all your losses disallowed. In other words, you can lose money overall, but when tax time comes you pay taxes on the gains and can’t deduct the losses. You can lose money overall and then lose even more by having to pay taxes on gains you never received because they were eaten up by losses that no longer count.

Be Very Careful.

Before you attempt “day trading” or making your next million in wall street bets or crypto, be very sure that you are not buying and selling the same thing over and over. The gains will be taxed, and the losses will not count. You will be paying far more in tax than you expect. If you don’t understand what you are doing, don’t do it. There is no free lunch and the IRS is happy to charge you for theirs, too.

Check with your tax or investment professional before investing in the latest trends.

Comments are closed.