1031 exchange is also known as a ‘like-kind’ exchange and it a method of deferring the taxes on the sale of a piece of property when you trade for something that is ‘like-kind’. It is a method of “kicking the can down the road” and paying the taxes later rather than now. Sometimes this is advantageous, and sometimes it is not. Often people come to me and tell me that their real estate agent or banker or brother-in-law told them that they NEED to do a 1031 exchange, or they will get killed on taxes. Will they?

Basic rules for 1031 Like-Kind Exchanges

The first thing to know is that since 2018, real estate is the only qualifying property. Semi-trucks, farm equipment, and everything else are no longer allowed. A 1031 is now limited to real estate only.

Second, this is not something you can do on a tax return at the end of the year. You must set it up prior to the closing of the property you are selling. The funds received from the sale go to a “Qualified Intermediary” (QI). The QI holds your funds until you buy the exchange property and then provides the funds at closing. Why? The IRS wants a third party involved to be sure the money only goes to the exchange and you get no other benefit during the exchange process. You are exchanging property for property and you do not get to hold the cash during the exchange.

Who is a Qualified Intermediary?

It can be almost anyone except your tax preparer, but it is usually your real estate agent or closing agent. Why? First, because they charge you, generally well over $1000, to hold your money during the exchange process. Second, I often hear that 1031 exchanges are the best thing since sliced bread and will save you millions. Finally, I have heard that you should set one up “just in case” to preserve your tax savings. If this person is not doing your taxes, they have no idea what you pay or what you could save. They are telling you the possible benefits you might get if you purchase their service.

This is not all the rules and is not meant to be comprehensive. There are rules for related parties, conflicts of interest, using the property as your home, and lots of rules for taking over debts and “throwing things into the deal” like money (sometimes called boot) or non-like-kind property like appliances and lawnmowers. If you are selling real estate with a possible gain, get tax advice BEFORE you close the sale.

What information do you need?

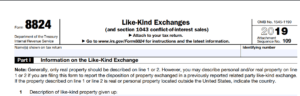

The first part of IRS form 8824 asks for a lot of dates and here is why: When you sell your property, the funds go to the QI at closing. Their information will be on your closing statement. Next, you have 45 days to identify the replacement property – what you are exchanging for. You need to contact your QI and identify the property and start the closing process. You have 180 days to close the purchasing sale from the date of the first sale. If you do not meet these time requirements, the QI returns your money and you do not get any tax breaks.

Calculating Your Gain

If you:

- sell your property at a considerable gain,

- buy another property to replace it, and

- you have a good deal of other taxable income that year,

then a 1031 Exchange can help. A 1031 exchange is completed on IRS Form 8824 and filed with your current year’s tax return. (1031 is the section of the law, not the form).

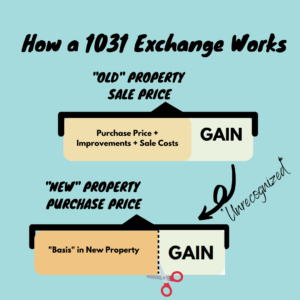

The deferred gain is calculated on Part Three of Form 8824. First, other property in the exchange (such as lawnmowers, appliances, and anything else you sold with the property) is pulled out of the equation. Then the value of any debts assumed, any cash received, and any closing costs are considered and the “realized gain” is calculated. The “realized gain” is the real gain on the sale of the property. It is then divided between “recognized gain” (what you have to pay taxes on this year (usually due to receiving a lot of cash) and “deferred gain” or “unrecognized gain” what you are electing to pay taxes on later.

That deferred gain just sits there indefinitely until you sell the new property that you just bought. When you sell the new property, whether next year or in 20 years, the amount of the last gain is added to the gain of this sale. At that point, you can choose to pay the taxes on both gains or do another exchange, kicking the can further down the road.

Will a 1031 help you? Big Mistakes to Avoid!

1 – If you sell your property at a loss, there is no gain to defer and no taxes to pay. Be sure to estimate your gain on the sale before you accept the buyer’s offer and set up the closing.

2 – If you owned your property over one year, you will be taxed at the Long-Term Capital Gains rate. This is the lowest tax rate. For 2020, if your income is less than $80,000 married or $40,000 single (including the gain) your tax rate could be ZERO. It does not make sense to defer paying the tax if it is zero.

3 – 1031 Exchanges only help if you are going UP in value and UP in debt. If you are buying a less-expensive property and paying off debt, you may not be able to defer any of the gain on the sale. Exchanges are designed to give you a tax break for sinking more money into investments. You generally cannot defer gains if you are downsizing.

4 – Cost of the exchange may be more than the tax savings. The amount of gain deferred is NOT how much you are saving in taxes. Say you have a $9,000 gain that you can defer. You are in the 15% bracket for Long Term Capital Gains. Your potential tax savings are $1350 (9000 x 15%). If the QI is going to charge you $1700 in exchange fees, it is costing you more to do the exchange than you are saving in taxes.

5 – If the property has been your home for 2 of the past 5 years, you may be able to exclude (not count as income) most of the gain and not pay taxes on it at all.

Summary

If you are selling a piece of real estate that is not your home, always check with your tax professional before you set up closing and get help deciding if a 1031 Exchange is best for you.