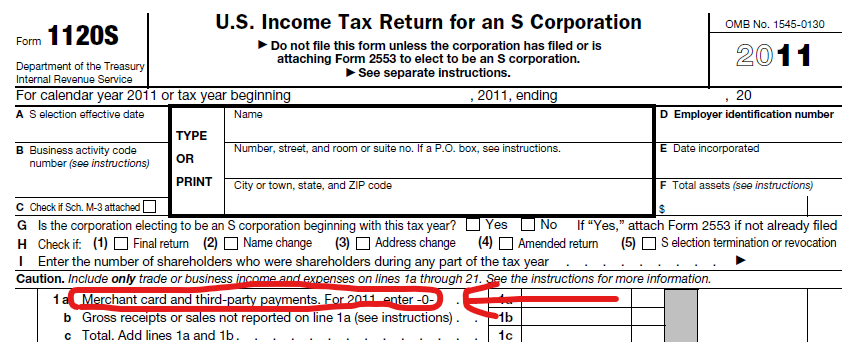

| Your 1099K is on hold again. It isn’t coming. I knew it. As the end of the year grew closer, I started writing blogs and planning strategies to deal with the incoming 1099K nightmare. I was figuring ways to reconcile the 1099K sent by the bank and the 1099-NEC or 1099-MISC sent by your customers so you would not pay taxes twice on the same money; planning how to report nontaxable income from 1099K so you wouldn’t get audited later. I was completely prepared for a replay of 2011 filing (the first year anyone got a 1099K), where they revised the tax forms mid-season because it was so awful. Headache pills were in my online cart. |

Rules Changed – On Hold AgainBut no. Somehow the government came to their senses and realized two things. First, that there is no way to enforce this in a clear, orderly manner. Too many variables in reasons why people receive electronic payments must be considered. Second, the only people that would be paying more in the long run were people out there hustling to pay the bills. The new $600 threshold for form 1099K hunts for pennies instead of dollars. It goes after micro-entrepreneurs and encourages taxpayers to report and pay tax on money that is not taxable. It only affects those who made less than $20,000 in sales all year. This law will never collect more tax than it costs to enforce. |

On Nov 21, 2023, the IRS decided that they need more time to figure out how to fairly apply the regulations for form 1099K. 2023 is going to be another ‘transitional year’ and you should not get a 1099K in January if you are under the old limits. The previous limit of $20,000 in transactions from a payer still stands.

| Let’s hope 2024 can be the year they quash this legislation for good.

The only people who can change it for good is Congress. Write to your representative in Congress and let them know how you feel. |

Comments are closed.