Carolina Hurricanes. San Jose Earthquakes. Chicago Fire. Colorado Avalanche. Am I talking about sports teams? No. I’m talking about the disasters behind the names. Disasters cause massive losses and often cost far beyond what insurance can cover. When the federal government helps by declaring a federal disaster area, federal money is released to aid the victims. Federal disasters can also get you a few tax breaks. Section 311 of the Secure 2.0 Act changed the rules for retirement funds and got disaster victims a few more breaks.

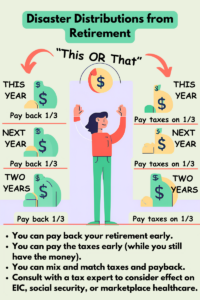

Retirement Funds Available for a DisasterIf you are in a federally declared disaster area, you can take up to $22,000 out of your retirement funds (401k or IRA). You have 180 days (six months) after the disaster to withdraw funds if you need them. The money is penalty-free (no 10% early withdrawal penalty), but it is NOT tax-free. That $22,000 is taxable income. But with everything tax, there is fine print. Most important, you can pay it all back over 3 years. No interest, no penalty. If you are having to wait weeks or months to get an insurance check, this may be a good solution for you. Take is out of retirement now, pay it back when the insurance pays. Paying Back Disaster FundsIt is always a good idea to pay back your retirement funds. Why? Because you will need it one day when you can’t work anymore. You can also avoid all taxes on your distribution if you pay it back. Unlike other emergency distributions, disasters have IRS form 8915-F for paying back your distributions. Also, unlike other emergency distributions, you don’t exactly have a full three years to pay it back. Disasters are paid back ‘ratably’ over 3 years. That means you either repay, or pay the tax on, one-third of the funds each year for three years. This starts the same year you withdraw the funds. In other words, if you take out $22,000, only $7667 is taxed in the first year (unless you pay it back). Then you add $7666 to your income the following 2 years if you choose not to pay it back.

Tax Complications if Not Paid BackRemember above when I said that taxes were withheld when you got the money? They withheld 20% of the $22,000, or $4400 for taxes. You are not going to owe $4400 in taxes on only $7666 (that year’s taxable amount). It is likely that you will get a nice tax refund in the Spring since you paid too much. However, if you do not set aside some of the money, you will have nothing paid toward taxes for the next two years when you have to include an extra $7666 in your income. Be sure to plan for this before you spend that tax refund and all the retirement money. (Save it!) Alternatively, you can pay all the taxes in the first year when you have the money. You should consult with a tax professional and be sure that including all the money does not disqualify you or reduce your Earned Income Credit, Social Security, or Marketplace health insurance based on your income. How to Pay It BackIf you can put the funds back in retirement, you keep track of that on Form 8915, which is filed with your regular taxes in the Spring. You will have to include that form for three years unless you pay it back or pay the tax sooner. If you took money from an IRA, you simply put it back into the IRA as a rollover contribution. If you took money from an employer 401k, you cannot pay it back to your employer. It is not a loan. It is paid back into your retirement by depositing it into a Traditional IRA. You need to designate it as a rollover contribution. ConclusionWhen disasters happen, you generally need money quickly. Retirement funds are an easy source of funds until you can get other assistance or make insurance claims. It is always best practice to replace the funds later, but if that is not possible, taxes on the withdrawal are paid over the next three years. |