What is Property Tax?

Property tax is one of the three main sources of income for Arkansas, along with Sales tax and Income tax. It is a tax you pay every year based on the value of what you own. All states charge a tax for owning real estate (land and buildings). Most states (including Arkansas), charge a tax on the business assets that you use to make money (Commercial Property Tax). Some states (like Arkansas), charge property tax on vehicles like cars, boats, and RVs (Personal Property Tax). This is all done by your local county and mostly goes to fund the roads, the court system, the libraries, and services like fire and police.

There are 2 stages to the process – Assessment and Collection.

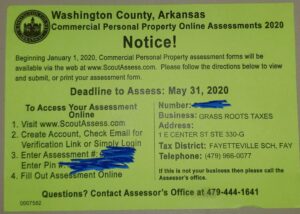

Assessment – When you assess, you tell the county what property you have. In Arkansas. this needs to be done by May 31 each year for any property you owned on May 31. If you bought a car, you probably assessed your personal property to get it tagged.

Collection – does not happen until the following year in October, a year and a half after assessment. This is called being paid ‘in arrears’. So, when you assess in May 2026, you do not pay the tax until October 2027.

Common Questions about Commercial Property Tax

“I have a home-based business, no office or shop. Do I still need to assess?” YES, If you are operating a business for profit in any capacity in the state of Arkansas, you need to assess with the county assessor by May 31.

“What if I have stuff that isn’t mine?” Do not list anything that you do not own, like things you are borrowing or repairing.

“I depreciated everything to zero years ago. It has no book value. Do I still list it?” Yes. They figure this for you. You need to state the original cost (what you paid originally including delivery) and the age. They figure the assessment value. It will not be zero. If it is helping you make money, it has some value.

“My business doesn’t own anything. I am not incorporated. It is all my personal stuff. Do I still need to assess?” Yes! Anything you use in your business to make money counts in this case. The minimum the assessor will accept is a computer of some sort and an office supply inventory of about $25.

“Do I have to have it notarized?” No. If you are the owner or authorized person signing it, you do not need a notary.

“I started my business this year. Do I need to assess?” Yes. If you are operating on May 31, you need to list your property as of May 31.

“How much is it?” That depends on your specific locality. The rates are decided at elections. Most places in Arkansas are about 50 mils. If you want to skip the government math, you can guess at around 1% of the market value of your property. So, if you have about $5000 in furniture and supplies as a consultant, plan on about $50 per year in property tax.

How to file Commercial Property Tax in Arkansas-Step-by-Step

Commercial property tax is filed on a four-page form in Arkansas. You can find the form by going to your County Assessor’s website and looking under commercial property assessment. The form is standard except for the name of the county and filing addresses. You can follow along on the Washington County form here. You can also file online at your county’s website and by phone, but the questions are going to be the same, so let’s get to it.

Page 1

Fill out your business information at the top. Not all will apply. If you are a sole proprietor (not incorporated), you will not have a corporate name.

Vehicles: Be careful to ONLY list the vehicles that are owned by the business. If your name (or your wife’s or little brother’s) is one the registration, it is already assessed as their property. Just because you use it for business and it is your ‘company car’, does not mean it is OWNED by the business. Things are assessed to their legal owner. Look at the title and registration. That is who pays the property tax.

LIST your off-road vehicles here – backhoes, excavators, mules, etc. If it is not tagged for road use, this is where you list it.

Signature at the bottom of page 1 – This is where you sign for the whole form. The assessor will also sign it after you submit.

Page 2

Furniture, fixtures, machinery, and equipment: List your computer, copier, filing cabinets, desks, chairs, business phones, and tools. DO NOT list your supplies or inventory here. What you list depends a lot on what your business does. Restaurants would list tables and chairs, pots, dishes, ovens, etc. An electrician would list hand tools. A crafter would list a display tent, display racks, and tables.

The assessor I spoke to a few years ago told me that if you do not list a computer or tablet of some kind, they will send it back. They know you are using something to run your business. So, list a computer or tablet, even if it is partly for personal use.

I would not list your personal cell phone. List the phones you bought for the business.

List only TANGIBLE property – physical objects. Software or anything that you only buy the rights to use is not tangible. Patents, Copyrights, logos, and other intellectual property are not tangible.

The price is how much you PAID for it, including shipping, installation, and setup. If you bought furniture from a store and had it delivered, include the delivery charge. Do not include the sales tax paid. If you bought a table for $20 at a yard sale, the value is $20. If your mom gave you a desk, list what you could sell it for today at a yard sale. Do not list a zero value. They will estimate a value and it will certainly be higher than your estimate.

Page 3

Parts and supplies inventory: This depends on your business.

Service businesses (consultants, professionals, trades, repairs, airbnb): This is all your “stuff” plumbing parts, wire, chainsaw blades, guest supplies like sheets and towels, and all the miscellaneous do-dads to carry out your business. If you are a consultant, you may not have any supplies.

Retail businesses and Manufacturers (restaurants, crafters, product sales): This is just your supplies, nothing that you will sell. Cleaning supplies and office coffee are good examples. Car dealers use the section below.

Office Supplies Inventory: According to the assessor I spoke with, you MUST list some office supplies. I suppose you could run a business with zero office supplies, but they will not believe you. You must list an average office supply inventory for the year, even if it is $25.

For both above, they are looking for what would be in your office (or on your truck) on an average day. If you generally buy parts as needed for jobs and do not have much leftover, you are only listing the average of the left-over parts.

Merchant’s Inventory: List last year’s average goods held for sale. This would be what you normally have on hand for sale. Remember to list everything at COST (what you paid for it). List everything, even if it is floor planned or consigned. They are looking for what you would have in stock for sale on an average day.

If you are a service business, LEAVE THIS PART BLANK. You do not have a resale inventory.

Leased property: List anything that you lease (like a copier) that you use in your business and the owner should pay the tax. Please check your lease. Many leases specifically state that you are responsible for paying the property tax. If so, it goes up in the assets section, not here.

Page 4

Page 4 is for manufacturers. You should have these numbers somewhere and be keeping track. If not, you need to be. This is more than I can cover here.

Do not list anything if you are an artist, crafter, etc. Self-made works of art are not inventory or manufactured items. They do not have monetary value until they are sold. The value of the supplies should be above.

The bottom of page 4 is filled out by the assessor.

Summing up

Once you have all your items listed and your numbers in order, you can sign and mail your form, assess online, or assess over the phone. Be sure to assess by May 31 to avoid a 10% increase in tax for assessing late.