I can deduct the work I do on my house, right? I get asked this often. The answer is… maybe? I think I give that answer to everything, so let’s see how selling your home is taxed and what you should be doing NOW to minimize future taxes.

There are different kinds of income

Believe it or not, all income is not created equal. Each type of income is calculated and taxed separately. You can earn money from work (active income), charging someone to use your money or assets (passive income), or buying and selling things that change the value (capital gains). The income and tax are calculated for each one separately. Active income (work) is subject to regular income tax AND Social Security / Medicare taxes. Passive income (interest, dividends, rental income) is subject to regular income tax and your losses can be limited. Capital gains (buying and selling things) are subject to capital gains tax.

Capital Gains Tax

Many of my clients think Capital Gains Tax is a scary, high tax. Actually, it is a lower tax. In some cases, it is zero. Capital gains rates kick in when there is more than a year between the purchase and the sale.

Why are capital gains rates lower? Tax laws are made by the government, not accountants, they have a different agenda. Often, tax laws are built to stimulate the economy. I had a relative that said, “If you spend your money the way the government wants you to, you won’t have to pay taxes.” Although I do not believe that to be completely correct, there is some truth in there. If the government wants people to do something, they lower the taxes on it. If they want people to stop, they raise the taxes on it. (For example, cigarettes, alcohol, indoor tanning, and not having health insurance were all taxed.) So, what do they want and why? Long term investors. Steady investments bring stability to the economy. The long-term rate is there to encourage people to look past the quick buck and invest long-term.

What does this have to do with my house?

Tax laws change all the time. Back in the early ’90s when I bought my first house, there was a once-in-a-lifetime chance for senior citizens to sell their house and not pay taxes on the capital gains. If you bought or sold your house before that, you had to determine if it was better to do an ‘exchange’ and move the value of what you have into a new property or pay the Capital Gains Tax on it.

Today, that once-in-a-lifetime chance has been changed to every two years. Tax laws change a lot. No one has any idea what the tax climate will be when you sell your house in 20 years or even 2 years. You must be prepared for everything.

Even with the current rules, I’ve had people paying Capital Gains Tax on the sale of their home. They moved for a job and rented out their house, thinking they would be back in a year or so. When the job went permanent after a couple of years and the kids liked the schools, they stayed there and put the old house up for sale. By the time they sold it, three years had passed from the time they moved out. It was no longer their home for 2 of the past 5 years (current rules). They came to me afraid they would owe Capital Gains Tax on the sale of their home.

Home Improvements made the difference

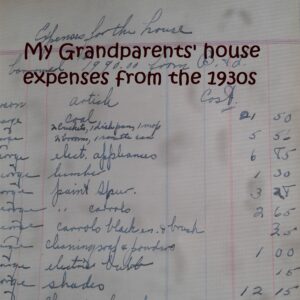

Generally, you cannot ‘deduct’ your home improvements. Most personal expenses are not deductions. But home improvements can be the “secret sauce” between owing taxes or not. I told my people above to go over everything they could find that they spent on their house. Did you put on a deck? New flooring? Fencing? Trees? Play structure? New windows? They kept nodding. I sent them on a scavenger hunt to find every receipt that was for home improvement.

Why? Because when you buy and sell things to make money (even your home) everything you put into it to make it more valuable is added to your ‘basis’ (Basis is a fancy word for the total investment.) Your gain is the difference between your total investment and the selling price. The more you spend making your home more valuable, the greater your total investment.

My clients came back with a list of improvements and receipts to back it up. They had spent over $15,000 fixing up their home. That was more than the gain, and they did not have to pay any tax on the sale of their home.

What should I do now?

Even though you cannot deduct home improvements on your taxes each year, keep track of every improvement you make. Regular maintenance and repairs are not improvements. Improvements are things that add to the value of the home. New flooring, programmable thermostat, new doorknobs, sidewalks, energy-efficient roof, new gutters, hedges, raised gardens, modern light switches. Any improvement, no matter how big or small, you should save the receipt and note the project details and date.

Keep it in a house folder. Keep your house purchase documents with every improvement ever made for that house in a safe place (scanned and online?). Have documentation for every dime you spend improving your house. Keep it in one place. When you sell your house, you can calculate your gain and take the best advantage of the tax laws in place at that time. If you do not remember what you did, how much you spent, or what year you did it, the IRS will not allow it. Good documentation, including notes on what was done, is the only thing standing between you and paying taxes that you should not owe.

You do not know when you will sell the house. The city could run a highway through it. You could win the lottery and move. Unfortunately, we do not have a crystal ball. Be prepared to be taxed when you sell your house and do everything you can NOW to keep from paying taxes later.

Like this post? Check out more from Grass Roots Taxes:

36 Things Your Accountant Can Do For You

What to Bring to Do Your Taxes

What’s all this stuff taken out of my check?