A Story of Two “New Guys”

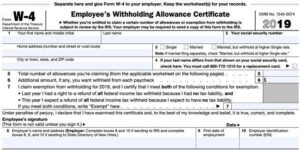

New guy #1 is Jack. Jack finished high school and, like most kids, had no idea what to do next. He sees an ad in the paper for a painter and he answers the ad because he helped his uncle paint the barn and other buildings lots of times. Jack gets through the interview and shows up Monday morning for his first day at his first full-time job. First thing when he gets to the shop: paperwork. He had to fill out a W4, and I-9, he had to show his driver’s license and Social Security card. He also had to sign a lot of policy stuff so he was clear on the no drinking, no drugs rules and other rules at work.

New guy #1 is Jack. Jack finished high school and, like most kids, had no idea what to do next. He sees an ad in the paper for a painter and he answers the ad because he helped his uncle paint the barn and other buildings lots of times. Jack gets through the interview and shows up Monday morning for his first day at his first full-time job. First thing when he gets to the shop: paperwork. He had to fill out a W4, and I-9, he had to show his driver’s license and Social Security card. He also had to sign a lot of policy stuff so he was clear on the no drinking, no drugs rules and other rules at work.

Two weeks later Jack gets his first paycheck. He has about a quarter of his money taken out to pay for taxes. Next spring, Jack files a tax return and gets a few hundred bucks back as a tax refund. Jack buys new work boots and a game console. All is good.

New guy #2 is Fred. Fred also got out of high school without a clue about his future. He sees an ad for a carpenter’s helper. Fred did some work around the house with his uncle and so he applied. He also got the job. Fred shows up Monday morning for his first day. First thing when he gets to the shop: “Hop in the truck, kid.” They go to the job site. His boss is impressed with his work ethic and skills. Friday comes around and he gives Fred a hand-written check for 40 hours at the agreed wage. Fred is super excited. No taxes! Woohoo!

Around Christmas, Fred’s boss asks him for his social security number and address. Though he really didn’t know why, Fred writes it on a scrap of paper and gives it to him. In January, Fred gets a 1099 form with his total earnings as “non-employee compensation.” Fred files a tax return online and finds he owes thousands in taxes. Fred talks to his boss, who won’t help him. Fred is grossly in debt and quits his job because he feels that his boss did this to him. No taxes turned out to be a lie. No one explained this to him. No game console for Fred.

Why didn’t Fred’s boss just pay him like he should have?

Well, Fred isn’t the only one with no idea. Fred’s boss probably had no idea this was a great inconvenience for Fred. He probably also didn’t know it was not lawful to pay employees as contractors. Many people tried having employees in the past and did not get help with payroll. When the IRS and state came after them for not paying correctly or filing the right forms, they decided payroll was “too complicated” or “too much trouble” so they wouldn’t have employees again. Other people are too afraid or are messing up the paperwork, so they just don’t try. Still others “just don’t want to do it that way” or worse, “we’ve never done it that way before and never had a problem.”

Fred’s boss lost a great employee and now he needs to find and train someone new.

How do I know if they are an employee or a contractor?

Sometimes your help isn’t an employee. What if you hire an architect to design your building? What if you hire a plumber to fix the restroom? They send you an invoice and you pay it. They are contractors. They are self-employed and pay their own taxes. How do you tell the difference?

The IRS published a 20-question test to help you decide. The questions are about control (can they tell you how to do your job or what tools to use), finance (do you have any investment or risk any loss), and relationship (do you do the same job for other people, can you send a replacement). An employer tells you when to show up, what to wear, how to do your job, they supply your materials, and they require that you personally do the work. (Click here to read more on IRS guidelines)

If you are getting paid as a non-employee, but doing the work of an employee, be aware that you will have to pay all the taxes that both you and your employer would normally pay. There is recourse you can take against your employer, but they will likely terminate your relationship once the IRS letters come pouring in.

If you are paying your people as contractors and treating them day-to-day as employees, stop. Right now. This can not only come back on you legally, but you will also most likely lose your best people come tax time. Payroll taxes and employment laws are not optional.

Like this post? Check out more from Grass Roots Taxes:

Plain Talk About Child Support

What to Bring to Do Your Taxes