This worksheet is specifically designed for retirement withdrawals for a new child. The IRS allows withdrawals up to $5000 from retirement funds for the birth or adoption of a new child under Section 311 of the Secure 2.0 Act. Under this 2022 law, you have three years to either pay it back to a retirement fund or pay the taxes on it.

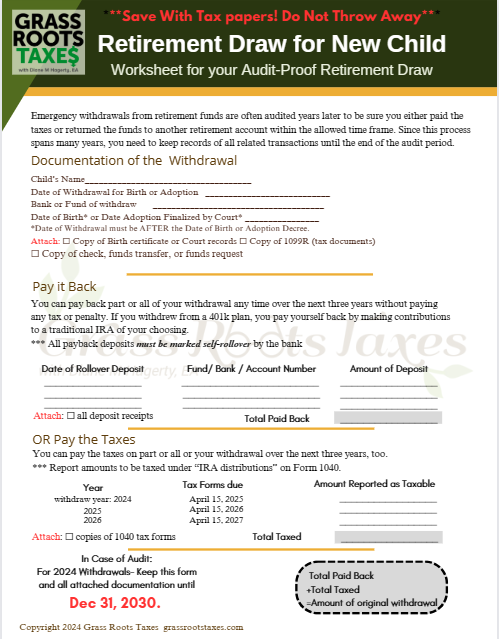

Emergency withdrawals from retirement funds are often audited many years later to check if you either paid the taxes or paid back the funds. Since this process spans many years, you need to keep records of all related transactions until the end of the audit period. 2024 withdrawals can be audited through 2030. You need to document all your transactions.

This worksheet helps you build a permanent record of all related transaction and tells you exactly what to keep in order prove to the IRS that you followed the letter of the law and do not owe any taxes or penalties on your retirement withdrawal for the birth or adoption of a new child.

Print the worksheet, attach all required information, and use it to prepare your taxes for the next three years after you make your withdrawal for a new child. After that, save this worksheet and attachments for an additional four years until the audit window expires.

Reviews

There are no reviews yet.