Big Changes

For decades the W4 form didn’t change much. Name, address, social security number, status (single or married), and how many exemptions. Sign, date, move on to the next piece of paperwork on your first day.

The form was flawed, but it worked well for most people. Single income households were easy peasy. The number of exemptions was the number of people in your family. Bam. Done. But not everyone is a single income household, and Grandma’s advice of putting “single zero” didn’t always work out so well.

Why Did It Change?

Here’s the breakdown: Withholding is based on each paycheck. If you make $1000 in a 2 week pay period, they withhold an appropriate amount of tax based on you making $25,000 at the end of the year. This is how bonuses get eaten by taxes. If you get a $1000 bonus, it is added to your paycheck. Now you have a $2000 paycheck and are taxed as if you are making $50,000 at the end of the year. Every paycheck is calculated as if you make that much all year.

What if you have 2 jobs or you are married and both work? Job 1 is the same as above. Job 2 is part-time and pays about $10,000 a year. Taxes at $10,000/year are zero in most cases. Your employer will not withhold anything. But you are actually making $35,000 and paying taxes as if you are making $25,000. The W4 had a lot of flaws that cause people to owe at tax time if they didn’t spend hours drudging over math worksheets or hiring a tax expert to do it for them.

The IRS decided to “fix” it in 2020. They got rid of the exemptions and went straight to YOU figuring out exactly what you will owe and giving your employer an amount to hold from each check. (Can you hear my head pounding on the desk?) At least they came up with a good tool, but I’ll get to that shortly. First, let’s look at the new form.

How to Fill It Out

Steps 1 & 5

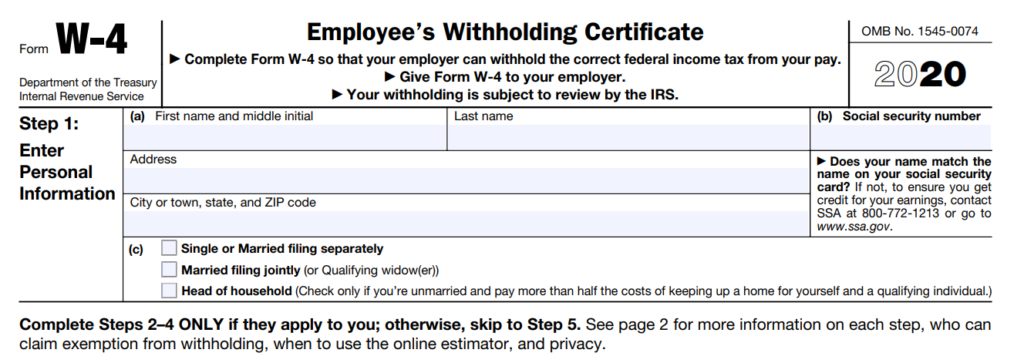

These steps are required. This is the easy part. Name, address, social security number, status (single or married), sign, date, move on to the next piece of paperwork on your first day. If you just do these two sections and nothing else, it will be similar to “single 1” or “single 0” from prior years and you should be OK if you file a single return with no dependents.

Steps 2, 3, and 4

These next steps are optional. They are nothing alike and are bizarre, even for an IRS form. Step 2 has one box. If you have 2 jobs that pay about the same, or you and your spouse both have one job and make about the same amount of money, and you have no other income, you can check this box and be done. I wouldn’t do this if you are claiming dependents. I also wouldn’t do this unless you are positive that your spouse also submits a new W4 to their employer at the same time. If your spouse is going to leave it on the seat of their car for 6 months, I would skip Step 2.

Step 3

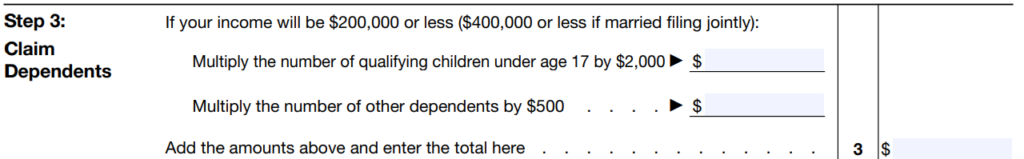

Next, this is where you claim your kids and other dependents. If you are single, enter who you are claiming. If you are married, you need to coordinate with your spouse and be sure your combined numbers equal the correct total. You can’t both claim all the kids or you will wind up owing taxes next spring. Be sure you know who is a ‘Qualifying Child’ and who is an ‘Other Dependent’. Any child who will be 17 or older at the end of the year is an ‘Other Dependent’. Your Qualifying Children are worth $2000 each and your Other Dependents are worth $500 each. Yes, you must do the math and enter a total. This was the easy part. Stay with me because it gets worse.

Step 4

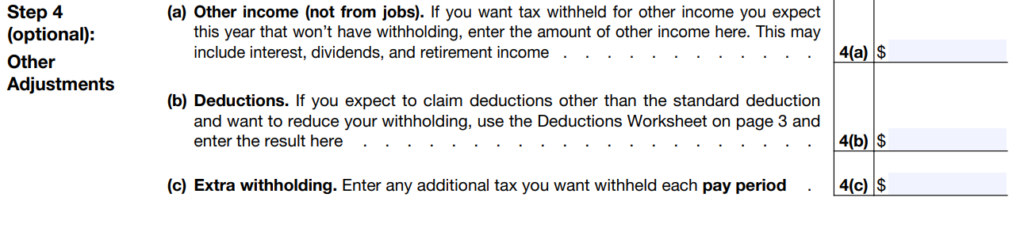

This one is where it gets weird, even for the IRS. 4a and 4b both scare me a little. 4a is “other income not from jobs”. You can list on this line all your other income you need to pay taxes on. Interest, dividends, rental income, side hustle income. I’m hearing sirens in my head. Telling your boss about your outside income just seems like a really bad idea. You’re moonlighting? You have rental properties? Sounds like stuff your new boss doesn’t need to find out on Day 1, or maybe ever.

Step 4b

Yuck. Just as bad. This is where you total up your deductions (standard or itemized) plus everything that goes on Schedule 1 (Student Loan interest, IRA contributions, etc.) and list the total there. Again, your boss just sees the total, but do you really want the whole HR Department speculating why you have so many deductions? Beyond that, I know exactly zero people who would know either number without looking at last year’s taxes. I also know zero people who can accurately predict their side hustle income for the year. Mind you, this is new hire paperwork that you fill out on Day 1 of a job you just started. And there’s a test on last year’s tax return??? Deep breath… there’s a glimmer of hope in Section 4c.

Step 4c

And finally, this is how much you extra you want withheld total per pay period. How do you figure that out? They rebuilt the online tool at IRS.gov/w4app. Enter all your information while you relax at home and get all the correct answers. You don’t have to disclose anything financial to your boss. You can take the correct numbers with you on your first day after you coordinate with your spouse. You can do a check-up at any time during the year and it’s free. It may take looking at last year’s taxes and coordinating with your spouse, but you can get it right and not wind up in tax trouble next Spring.

In Conclusion

Form W4 has changed dramatically. Don’t get caught by surprise on Day 1 at a new job. Use the calculator at www.IRS.gov/W4app prior to starting your new job.