Can I take money out of my 401k for having a baby? What about adoption? Do I have to pay tax and penalties? Can I pay myself back?

The Secure Act 2.0 was passed in December 2022 and made a lot of changes to what you can do with your retirement money. The first Secure Act in 2020 allowed for a $5000 penalty-free hardship distribution for the birth or adoption of a new child. Section 311 of Secure 2.0 allows you to take the distribution and allows you to pay it back over 3 years.

Why this is important: It encourages you to keep your retirement money for retirement and not use it for emergencies and life changes. It allows you to ‘borrow’ it and pay it back to yourself without any penalty or taxes. But with all things tax, you need to read the fine print.

Technically a Rollover

The IRS code section 72(t)(2)(H)(v)(I) says that hardship withdrawals for a new child are treated like a rollover. A ‘rollover’ is where you can take money out of retirement and put it back within 60 days. This allows you to move your money around and invest however and wherever you please.

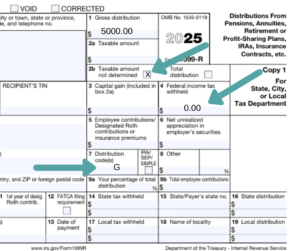

A hardship distribution for a new child should be treated as a rollover, but with three years to pay it back instead of only 60 days. Note that I said ‘should be.’ Employers may or may not be familiar with the law and may not issue your 1099R tax statement correctly. It should be marked as a rollover (Code G in Box 7), no taxes withheld, and no taxes due when you file in the Spring. If it is marked otherwise, see a tax professional or consult with the sender. Check the image below to compare your 1099R.

Distributions are Income

If you take a distribution, it is income. The money in your retirement was never taxed, so when you take it out, you must pay income tax. Secure 2.0 allows you to pay your distribution back over 3 years so you do not have to pay the tax until you retire.

What happens if you don’t pay it back? You are taxed on what was not paid back at the end of the three years. It will add the $5000 income to the final year.

Tax will be due April of the 4th year after you take it out. If you do not remember, the IRS will certainly ask you about it. Keep good records so you can show that it was paid back or be sure that you report it as income and pay the tax if you are not paying it back.

Additional income can affect your overall tax situation like eligibility for Earned Income Credit, Education Credits, how much of your Social Security is taxable, the price of your Marketplace health insurance, and more. You need to consider all the tax implications of having additional income if you decide not to pay it back.

How to ‘Pay it Back’

If you took money from an IRA, you can simply put it back within the three years.

If you took money from an employer 401k plan, you cannot directly pay it back to your employer. It is not an employer loan. You can, however, open a traditional IRA and make ‘rollover’ contributions. You can deposit up to the original $5000 over the next 3 years. This is ‘paying it back’ into your retirement. That way, you are not paying taxes on the money or reporting it as additional income.

Final Note

The qualifying withdrawal cannot be made until after the baby is born or the adoption is finalized. You cannot take the money out ahead of time.

Try my “Audit-Proof Worksheet” to keep track of distributions and paybacks. Have the receipts in one place when the IRS starts asking questions. It’s in my shop.