Arkansas nonprofits have several required forms to file with the state. These are not “tax forms” but forms to keep you in compliance with the law. You probably need to file 2 or 3 forms – one for the annual board report, and one or two for your solicitation activity. There is no charge to file the forms and they are all fairly simple.

Step One – The Annual Report

You need to file your board report by August 1st every year with the Arkansas Secretary of State.

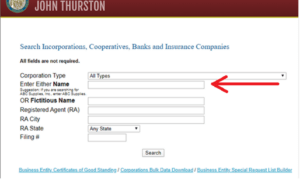

The form is a simple one-page form to report your contact information and board members. Click here: https://www.sos.arkansas.gov/corps/search_all.php

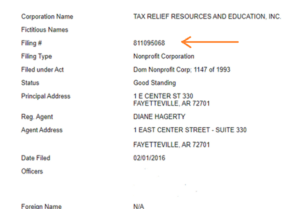

Enter your organization’s name in the search box. It is better to use fewer words in the search if you cannot find your organization on the first try. Click on your organization in the list and you will get this screen:

Directly under your name is your filing number. You will need to highlight and copy the filing number for the next screen. Scroll down and click on “Submit a Nonprofit Annual Report.” Scroll down again on that screen until you see the little, white box that says, “Start Form.” Paste the filing number there and click “Start Form” and you are on your way.

The form will need to be signed by an officer or director. Be sure to carefully enter your email address because that is how you get your file-marked, accepted form.

Step Two – Solicitation Registration and Reports – Are you Exempt?

First, you need to see if you are exempt from filing the solicitation report. If you are a religious organization, an educational institution, a political candidate or organization, a hospital, or any organization that received less than $50,000 in donations AND has no paid workers, you are exempt. However, you still need to fill out form Form EX-01. You will need to outline any soliciting that you are doing, including Facebook donations, YouTube donate button, and any other instance where you ask Arkansans for money. Be clear and complete.

You need to have it notarized, attach a copy of your IRS tax exemption letter and your Articles of Incorporation, and EMAIL it to charities@sos.arkansas.gov . Email is still the only filing option. (Someone tell them this is the 21st century… )

You need to file this every year within 6 months of the end of your fiscal year. The Attorney General is not a mind-reader. If you are exempt, you have to tell them you are exempt. Every year.

I am NOT exempt from filing solicitation – Now what?

If you do not qualify as exempt, you need to file 2 forms. The Registration form CR-01 and the Annual Financial Reporting Form CR-03

The Registration form asks for basic information about how you solicit money and your fundraising activities and should only take a few minutes to complete.

The Annual Financial Reporting Form is an information update about the organization and a recap of the numbers from your latest form 990 or 990EZ. File the solicitation reports once you complete your 990.

Have both forms notarized, include your latest 990 filing, your IRS exemption letter, your articles of incorporation, and EMAIL it to charities@sos.arkansas.gov . Again, email is the only filing option.

Important Exceptions

If you had over $500,000 in gross receipts (that includes grants, sales, in-kind, everything) OR if you used paid solicitors OR if you used professional fundraisers, there are MORE FORMS and MORE STEPS. You should get help and carefully read all the instructions on the Secretary of State’s website. https://www.sos.arkansas.gov/business-commercial-services-bcs/nonprofit-charitable-entities/charitable-entities/

Remember WHY We Do This

The State needs to protect its citizens against scammers and fake charities. Registering as a solicitor and clearly stating your purpose and accomplishments gives you credibility and transparency. People can look you up here: https://www.sos.arkansas.gov/corps/charity/index.php and feel confident that you are not a scammer or fly-by-night organization.