Surviving the Payroll Nightmare

Then the biggest, scariest monster of all shows up (the IRS) and tells you that payroll is not optional and you have to comply with all these laws you don’t even know about.

Do I Owe Inheritance Tax?

Estate tax is paid by the estate. If you have an estate with enough wealth to owe estate tax, probate court is already involved and overseeing the bill payments and valuation of your property.

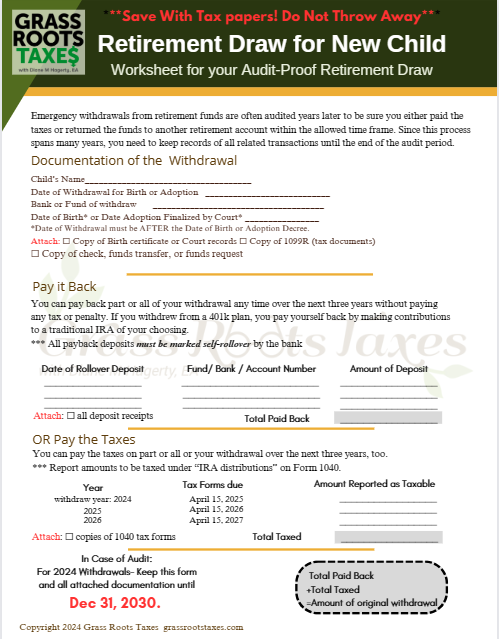

Can I take money out of my 401k for having a baby?

A hardship distribution for a new child should be treated as a rollover, but with three years to pay it back instead of only 60 days.

Paying Taxes on Inherited Property

If you inherit a piece of land or a car or jewelry or anything that isn’t cash, and you turn around and sell it immediately, chances are that your taxes are zero.

What is Tax Evasion?

What is Tax Evasion? Am I Evading Taxes? This a very common question, and Diane is here to help explain in this video.

Why Do I Get Different Answers From Different Tax Professionals?

Why are there different answers from different people? Laws are conflicting, situations are complex… get the full explanation here.

Plain Talk About Child Support

Child support explained by an accounting expert. Understand why the child support system is the way it is and how to navigate it successfully.

Tax-Deductible Receipt for your Church or Charity

You need to comply with recent IRS rule changes and provide a tax-deductible receipt to your donors for money and used good donations.

Piercing the Corporate Veil

How Single Member LLCs, Shipwrecks, and the Dog Groomer can cost you money. Be sure your small business is not piercing the corporate veil.

Nine things you need to do for your small business or side gig in January 2026

Nine things you need to do now (Before you file your taxes) Income Checkup – If you are going to we over $1000 at the end of the year (federal or state), make an estimated payment by January 15th. IRS paycheck checkup tool can help: https://www.irs.gov/paycheck-checkup 1099s – Get contract workers’ information and total what […]